The global Invoice Factoring Market is experiencing remarkable growth, driven by the increasing demand for alternative financing solutions among businesses of all sizes. Invoice factoring, a financial tool that enables businesses to convert outstanding invoices into immediate cash, is gaining traction as companies seek improved cash flow and working capital management.

Market Values

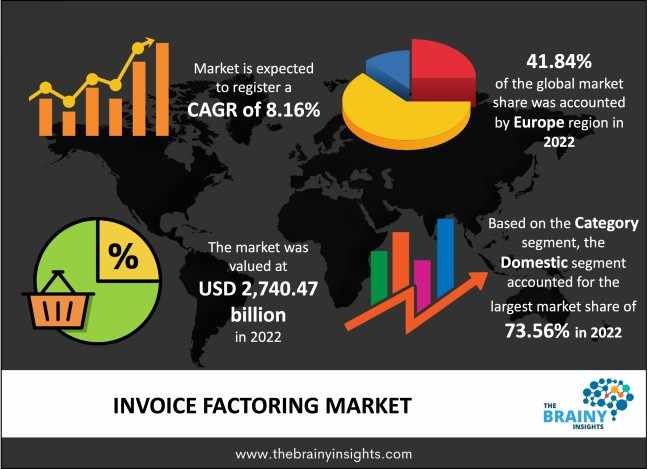

According to recent industry reports, the global invoice factoring market, valued at USD 2,740.47 billion in 2022, is projected to expand at a CAGR of 8.16% from 2023 to 2032. The rising number of small and medium-sized enterprises (SMEs) and the need for quick access to capital are key drivers fueling market expansion.

Regional Analysis

The invoice factoring market is witnessing significant growth across various regions:

North America: The region holds a substantial market share due to the strong presence of SMEs and a well-established financial ecosystem.

Europe: Increasing adoption of factoring services in countries such as the UK, Germany, and France is contributing to steady growth.

Asia-Pacific: The region is expected to witness the highest CAGR, driven by the rapid expansion of SMEs and increasing awareness about alternative financing solutions.

Latin America & Middle East: Emerging markets in these regions are gaining traction, with businesses seeking flexible financing options to support growth initiatives.

Market Dynamics

Key factors influencing the growth of the invoice factoring market include:

Drivers: Increasing need for cash flow management, rising number of SMEs, and the growing adoption of digital factoring platforms.

Challenges: High service fees, lack of awareness among small enterprises, and concerns over bad debts.

Opportunities: Technological advancements, blockchain integration, and the emergence of AI-driven factoring solutions.

Market Segmentation

The invoice factoring market is segmented based on:

Type: Recourse and Non-Recourse Factoring

Enterprise Size: Small & Medium Enterprises (SMEs) and Large Enterprises

Industry Verticals: Manufacturing, Healthcare, Transportation, IT & Telecom, Retail, and Others

Key Trends

Rise in digital factoring platforms and fintech-driven solutions.

Growing adoption of blockchain technology for enhanced security and transparency.

Increasing preference for non-recourse factoring among businesses.

Expansion of factoring services into emerging markets.

Key Players

Leading players in the invoice factoring market include:

American Express Company

ICBC

Lloyds Bank

Sonovate

Velotrade

Adobe

Intuit Inc.

Waddle

Porter Capital

Barclays Bank UK PLC

Request to Download Sample Research Report- https://www.thebrainyinsights.com/enquiry/sample-request/13488

Conclusion

The global invoice factoring market is poised for substantial growth, driven by increasing demand for working capital solutions and advancements in financial technology. As businesses continue to explore alternative financing options, invoice factoring is expected to play a pivotal role in enhancing financial flexibility and business sustainability.

Write a comment ...